Duurzaam en verantwoord beleggen

Een goed pensioen in een leefbare wereld

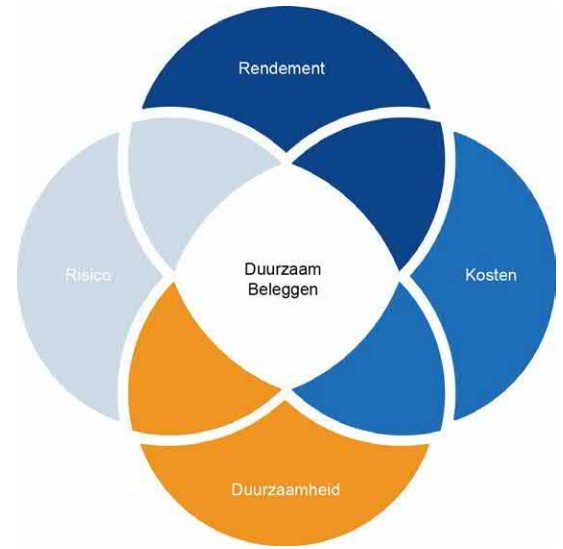

We vinden het belangrijk om ons duurzaamheidsbeleid blijvend te toetsen zodat we jou, onze deelnemer, nu en in de toekomst een goed pensioen kunnen bieden. Een pensioen waar je van kunt genieten in een leefbare wereld. Daarom letten we bij elke beleggingsbeslissing op rendement, risico, kosten én de prestaties op het gebied van duurzaamheid, en herijken we ons beleid doorlopend.

Met het oog op een duurzame toekomst, blijven we onze inspanningen onverminderd voortzetten, en blijven we ons inzetten voor het bevorderen van duurzaamheid in elke laag van ons beleggingsbeleid.

Lees hier meer over ons duurzaamheidsbeleid.

Lees hier meer over ons duurzaamheidsbeleid.

Of wil je weten wat we verstaan onder duurzaam beleggen, bekijk dan deze algemene, korte video (klik op afbeelding) over Duurzaam beleggen: het nieuwe normaal.

Of wil je weten wat we verstaan onder duurzaam beleggen, bekijk dan deze algemene, korte video (klik op afbeelding) over Duurzaam beleggen: het nieuwe normaal.

Hoe Pensioenfonds PDN dit aanpakt lees je hier in vogelvlucht.

Jouw financiële en sociale belangen in balans

We zien het als onze voornaamste taak om te blijven zorgen voor een goed pensioen, nu en later, daarom beleggen we de pensioenpremies van onze deelnemers op een verantwoorde manier. Rendement en een intelligent duurzaamheidsbeleid werkt wat ons betreft prima samen. Juist door informatie over mens, milieu en goed ondernemingsbestuur mee te nemen in ons beleid, worden meer weloverwogen beleggingsbeslissingen genomen. Zeker omdat we beleggen voor de lange termijn.

Duurzame ontwikkelingsdoelen

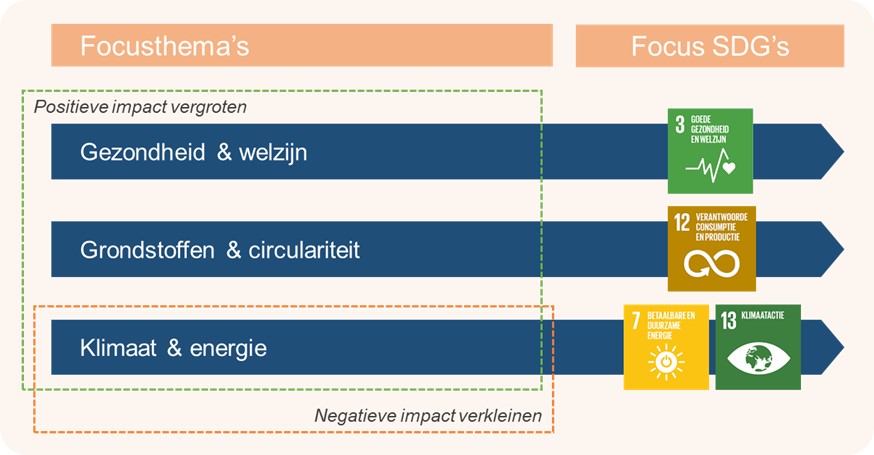

Doordat we ons verbinden aan Europese richtlijnen en principes, geven we aan dat we ons focussen op specifieke maatschappelijke ontwikkelingen die voor onze deelnemers belangrijk zijn én als risicovol zijn geïdentificeerd voor de beleggingsportefeuille.

We richten ons op dit moment specifiek op 3 thema's: gezondheid en welzijn, klimaat en energie én grondstoffen en circulariteit. Deze thema’s zijn gekoppeld aan vier duurzame ontwikkelingsdoelen van de Verenigde Naties, de Sustainable Development Goals (SDG’s). We kijken dan met name naar:

SDG 3 – goede gezondheid en welzijn;

SDG 7 – betaalbare en duurzame energie;

SDG 12 – verantwoorde consumptie en productie; en

SDG 13 – klimaatactie. Overzicht focusthema's en -SDG's

Overzicht focusthema's en -SDG's

Aanscherping uitsluitingenbeleid

Pensioenfonds PDN wil niet betrokken zijn bij de financiering van landen of bedrijven die ongepaste activiteiten ontplooien. Zoals bedrijven betrokken bij de productie van tabak, bedrijven die 5% of meer van hun omzet halen uit kolen- of teerzandwinning en bedrijven die betrokken zijn bij de productie van controversiële wapens, zoals clustermunitie, landmijnen, chemische of biologische wapens, verarmd uraniummunitie, witte fosfor munitie en nucleaire wapens. Ook landen die zich niet houden aan internationale verdragen of waarop een sanctie van de VN, EU of Nederland rust, worden uitgesloten van belegging. Hierbij gaat het voornamelijk om vraagstukken omtrent mensenrechten, wapenproliferatie en democratische rechten.

Beleidsinstrumenten als basis

Het duurzaamheidsbeleid van Pensioenfonds PDN is opgebouwd rondom 6 beleidsinstrumenten. Deze instrumenten vormen de basis en zijn:

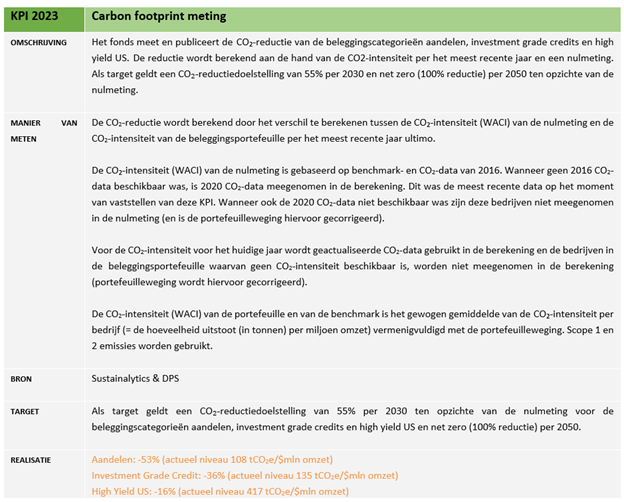

Pensioenfonds PDN benut waar mogelijk ESG-factoren in het beheer en voor de beoordeling van beleggingen. ESG staat voor Environment (omgeving/milieu), Social (sociaal) en Governance (ondernemingsbestuur). Duurzaamheidsrisico’s voor de portefeuille en andere ESG-aspecten worden meegenomen in investeringsbeslissingen in de diverse mandaten. Een ander tot de verbeelding sprekend onderwerp dat hieronder valt is CO₂-uitstoot. Met ESG-integratie in het beleggingsproces probeert Pensioenfonds PDN de CO₂-uitstoot van de beleggingsportefeuille te verminderen.

Realisatie doelstellingen Co2 reductie

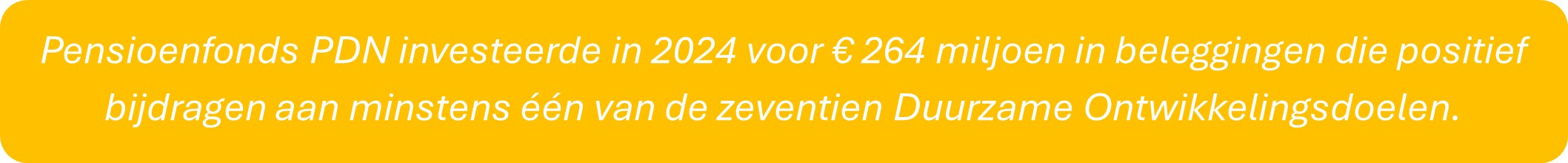

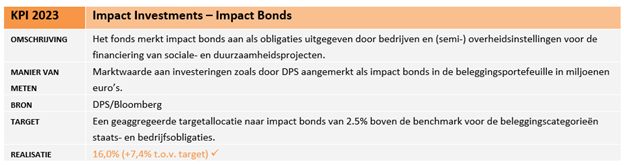

Impact investing is het investeren in landen, bedrijven of projecten die ook maatschappelijke en milieuproblemen helpen oplossen, zoals armoede in ontwikkelingslanden en klimaatverandering. Pensioenfonds PDN doet dit aan de hand van de Sustainable Development Goals van de Verenigde Naties.

Realisatie doelstelling Impact Investments

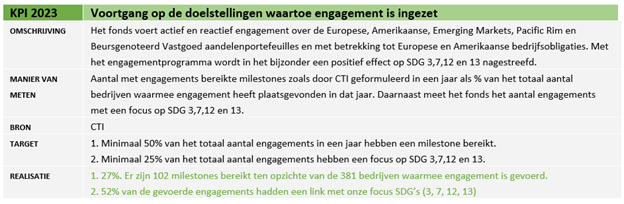

Bij engagement wordt de dialoog aangegaan met bedrijven waarin is belegd. Op deze manier kunnen stakeholders bedrijven stimuleren om te veranderen. Middels het instrument engagement is het mogelijk om met bedrijven afspraken te maken over plannen, doelen of ambities. Bijvoorbeeld ten aanzien van een CO₂-reductie. Ook wordt met behulp van engagement met bedrijven, die gedrag vertonen dat niet in lijn ligt met de principes van de UN Global Compact en waar (potentiële) negatieve impact is geïdentificeerd, een traject van intensieve dialoog gestart. Een engagementtraject kan als een proactief of reactief engagementtraject worden bestempeld. Wanneer het engagementtraject niet tot het gewenste resultaat leidt is in de escalatieladder aangegeven onder welke voorwaarden desinvestering zal plaatsvinden.

Engagement proces

Een engagement traject bestaat uit vier fases. Het begint bij het vaststellen van een bedrijfsspecifieke doelstelling. Daarna treedt CTI in contact met het desbetreffende bedrijf om de vastgestelde problemen aan te kaarten. Hierna wordt door CTI gemonitord in hoeverre het bedrijf toezeggingen doet om het probleem aan te pakken tot aan het moment dat de problemen zijn opgelost en de doelstelling zijn behaald. Helaas is dat laatste niet altijd het eindstation van een engagement traject. Bedrijven kunnen ergens tijdens deze fases ‘niet thuis geven’ waardoor een engagement traject moet worden afgebroken.

Realisatie doelstelling Engagement

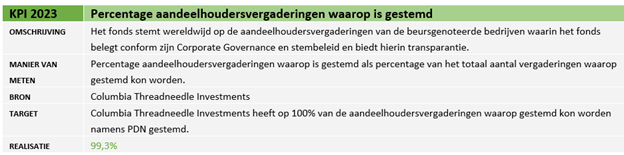

Als institutionele belegger leeft Pensioenfonds PDN de Nederlandse Corporate Governance Code na. Deze code bevat principes en bepalingen over goed bedrijfsbestuur. Het beleid van pensioenfonds PDN voor goed bestuur is erop gericht om onze belangen als aandeelhouder te beschermen en invulling te geven aan onze verantwoordelijkheid als aandeelhouder. Wanneer er aanwijzingen zijn dat een bedrijf onverantwoord onderneemt, bestaan verschillende mogelijkheden waarop Pensioenfonds PDN zijn invloed kan doen gelden, waaronder het stemmen op de aandeelhoudersvergaderingen van alle beursgenoteerde bedrijven waarin het fonds wereldwijd belegt.

Op onze website publiceren we ieder kwartaal hoe er is gestemd op de algemene vergadering van de ondernemingen waarin we beleggen. Dat doen we per individuele onderneming en per stempunt.

Realisatie doelstelling Stemming en Corporate Governance

In 2024 hebben er 1017 aandeelhoudersvergaderingen plaatsgevonden voor alle beursgenoteerde bedrijven in de portefeuille van Pensioenfonds PDN. Op 1014 van die vergaderingen heeft CTI namens Pensioenfonds PDN kunnen stemmen. Voor 3 vergaderingen was dat niet mogelijk door geldende liquiditeit beperkende voorwaarden of andere operationele restricties in het stemproces.

Op alle 1014 aandeelhoudersvergaderingen is er op meer dan 13.000 voorstellen gestemd. Zoals hierboven benoemd, was het niet mogelijk om op een aantal aandeelhoudersvergaderingen te stemmen waardoor in totaal op 0,5% van het aantal voorstellen niet gestemd is. Op de overige 99,5% is wel gestemd.

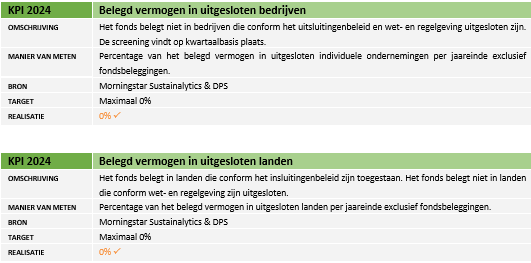

Pensioenfonds PDN belegt op een dusdanige wijze dat zijn beleggingen een afspiegeling zijn van de eigen normen en waarden. Het fonds sluit daarom bedrijven en landen uit op basis van risico op negatieve impact en conflict met zijn normen en waarden. Pensioenfonds PDN hanteert hierbij criteria zoals de schadelijkheid van het product, de onmogelijkheid om verandering teweeg te brengen door middel van stemmen en engagement, en het gegeven dat er nadelige gevolgen zouden zijn wanneer het product niet meer zou bestaan.

Productgroepen die we bijvoorbeeld (gedeeltelijk) uitsluiten zijn controversiële wapens, clustermunitie, kolen, olie uit teerzanden en tabak. Bedrijven of landen die we uitsluiten op basis van hun gedrag zijn gebaseerd op de 10 principes van de VN Global Compact en internationale sanctielijsten van de VN Veiligheidsraad, Nederland en-of de Europese Unie. Bij ernstige en structurele schending worden landen en bedrijven toegevoegd aan onze uitsluitingenlijst.

Realisatie doelstellingen Uitsluiting

Onze KPI bij uitsluitingen houdt in dat we geen beleggingen aanhouden in bedrijven en landen, exclusief onze fondsbeleggingen, die op onze uitsluitingenlijst staan . Dit target hebben we gehaald. Binnen een kwartaal na screening werden individuele beleggingen in bedrijven en landen die op de uitsluitingenlijst stonden verkocht. Pensioenfonds PDN sluit eind 2024 in totaal 167 bedrijven en 14 landen van het beleggingsuniversum uit.

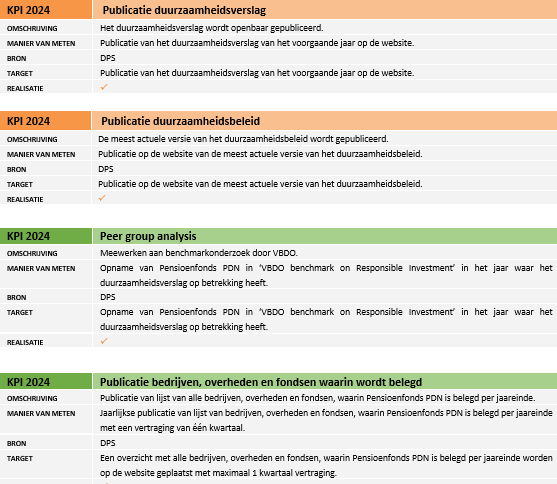

Om transparant te zijn over het duurzaamheidsbeleid en de uitvoering daarvan, publiceert het fonds jaarlijks een duurzaamheidsverslag. Daarnaast publiceert Pensioenfonds PDN op zijn website op jaarbasis een overzicht van de totale beleggingsportefeuille en rapporteren we op de website over de uitkomsten van het stemgedrag op aandeelhoudersvergaderingen. Tot slot participeert het fonds aan marktbrede initiatieven zoals de VBDO benchmark en de PRI-assessment van de VN.

Realisatie doelstellingen Transparantie

Verslaglegging

Om transparant te zijn over het duurzaamheidsbeleid en de uitvoering daarvan, publiceert Pensioenfonds PDN jaarlijks een duurzaamheidsverslag. In dit verslag geven we aan hoe we in het desbetreffende jaar met duurzaamheid zijn omgegaan en welke resultaten er op het gebied van duurzaamheid zijn bereikt.

In het kader van openheid over waar het fonds in belegt publiceren we op onze website op jaarbasis een overzicht van onze totale beleggingsportefeuille. Voor meer informatie bezoek onze website Beleggingsbeleid bij Pensioenfonds PDN. Ook rapporteren we op onze website over de uitkomsten van het stemgedrag op aandeelhoudersvergaderingen. Tot slot zijn er regelmatig items in het PDN Magazine en op de website te vinden over het duurzaamheidsbeleid.

Toekomstperspectieven

In het komende jaar zullen we ons blijven inzetten voor de verdere ontwikkeling en implementatie van ons duurzaamheidsbeleid.

Als we vooruitkijken, zien we diverse belangrijke thema's die onze aandacht verdienen:

- Digitale transformatie en duurzaamheid: De rol van technologie in het bevorderen van duurzaamheid is onmiskenbaar. Innovaties kunnen bijdragen aan energie-efficiëntie en de ontwikkeling van slimme, duurzame steden.

- Waterbeheer: Duurzaam beheer van onze waterbronnen is essentieel om de toekomstige generaties van voldoende schoon water te voorzien.

- Sociale inclusie en werkgelegenheid: Door te investeren in duurzame projecten kunnen we bijdragen aan het creëren van banen en het bevorderen van sociale inclusie, vooral in ontwikkelingslanden.

- Circulaire economie: Het ondersteunen van bedrijven die de principes van de circulaire economie omarmen, is een stap naar het minimaliseren van afval en het efficiënt gebruiken van resources.

- Ethisch beleggen en mensenrechten: Het is onze verantwoordelijkheid om ervoor te zorgen dat onze beleggingen ethische overwegingen en respect voor mensenrechten omarmen.

- Biodiversiteit: Het beschermen en bevorderen van biodiversiteit is essentieel voor het behoud van gezonde ecosystemen, die cruciaal zijn voor het leven op aarde. Meer en meer komt er binnen de investeringswereld aandacht voor investeringen die bijdragen aan de bescherming van natuurlijke habitats en de diversiteit van soorten.

We zien de complexiteit van de uitdagingen waar we voor staan en tegelijkertijd zien we de mogelijkheden om een positieve impact te maken. Met toewijding, innovatie, en samenwerking kunnen we bijdragen aan een duurzamere en rechtvaardigere wereld voor iedereen.