Sustainable and responsible investing

A good pension in a liveable world

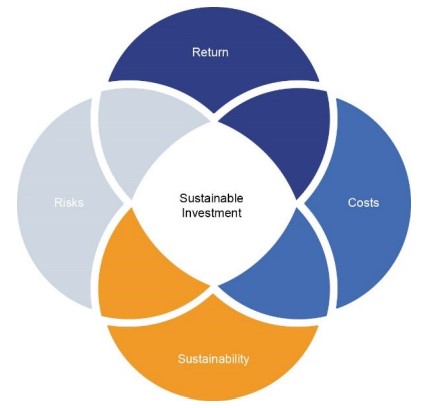

We believe it is important to continually assess our sustainability policy so that we can provide you, our member, with a good pension now and in the future. A pension that you can enjoy in a livable world. Therefore, we pay attention to return, risk, costs, and performance in terms of sustainability in every investment decision, and we continuously reassess our policy.

In view of a sustainable future, we will continue our efforts unabated and remain committed to promoting sustainability at every level of our investment policy.

Click here for more detailed information about our Sustainability Policy.

Click here for more detailed information about our Sustainability Policy.

If you would like to know what we mean by sustainable investing, you can watch a general short video entitled ‘Sustainable Investing: the new normal’ by clicking on the ‘Duurzaam beleggen’ image.

If you would like to know what we mean by sustainable investing, you can watch a general short video entitled ‘Sustainable Investing: the new normal’ by clicking on the ‘Duurzaam beleggen’ image.

You can read a brief overview of how Pensioenfonds PDN addresses this here.

Your financial and social interests in balance

We see it as our main task to continue to provide a good pension, now and in the future, which is why we invest our members’ pension contributions in a responsible way. Good returns and an intelligent sustainability policy go hand in hand as far as we are concerned. In fact, incorporating information about people, the environment and good corporate governance in our policy enables us to take better-informed investment decisions. Especially since we are investing for the long term.

Sustainable Development Goals

In committing to these European guidelines and principles, we aim to focus on specific societal developments that are important for our members and have been identified as high risk for the investment portfolio.

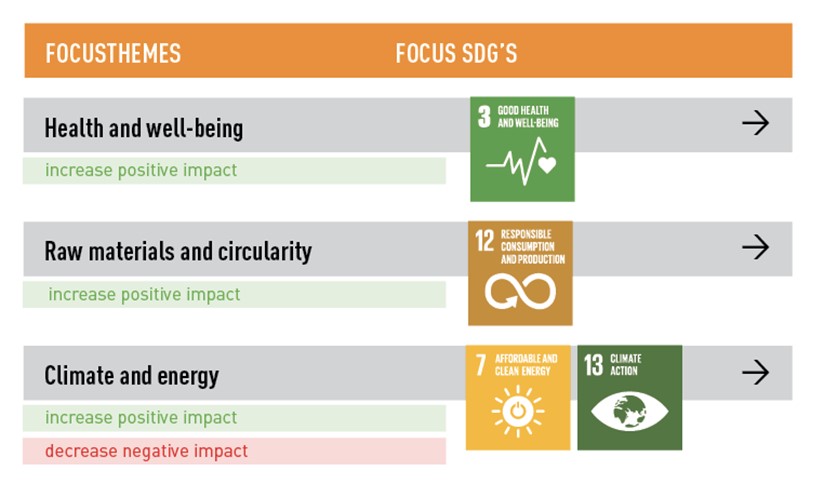

Our sustainability policy currently focuses specifically on three themes: health and well-being, climate and energy, and raw materials and circularity. These themes are linked to four of the United Nation’s Sustainable Development Goals (SDGs). We are focusing more specifically on:

SDG 3 - good health and well-being

SDG 7 - affordable and clean energy

SDG 12 - responsible consumption and production, and

SDG 13 - climate action.

Overview of Focus Themes and SDG's

Streamlining the exclusion policy

Pensioenfonds PDN does not want to be involved in financing countries or companies that engage in inappropriate activities. This includes companies involved in the production of tobacco, companies that obtain 5% or more of their turnover from coal or tar sand mining, companies involved in the production of controversial weapons such as cluster bombs, land mines, chemical and biological weapons, depleted uranium ammunition, white phosphorus bombs and nuclear weapons. Countries that do not adhere to international treaties or that are under UN, EU or Dutch government sanctions are also excluded from investment. In most cases, the sanctions relate to human rights, arms proliferation and democratic rights.

Policy instruments as basis

Pensioenfonds PDN’s sustainability policy is built around six policy instruments. These instruments form the basis of the policy and are:

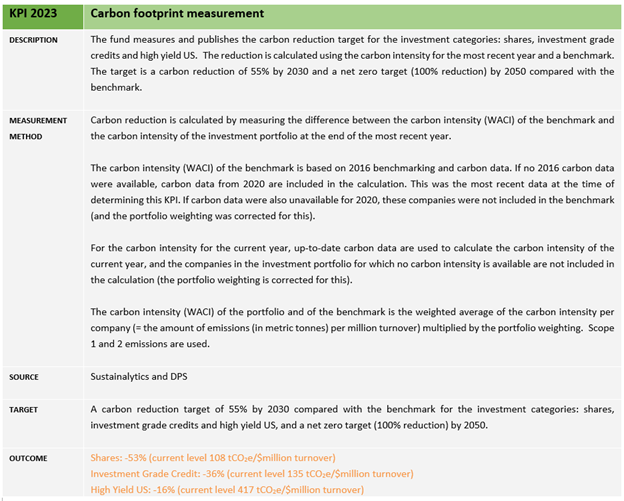

Where possible, Pensioenfonds PDN manages and evaluates investments according to ESG factors. ESG stands for Environmental, Social and Governance. Sustainability risks for the portfolio and other ESG aspects are considered when making investment decisions in the various mandates. Another illustrative topic that falls within this is carbon emissions. Pensioenfonds PDN aims to reduce the investment portfolio’s carbon emissions via ESG integration in the investment process.

Whether this target is achieved can only be determined after 2030. We can, however, monitor our carbon emission reduction progress in the meantime.

Outcome of carbon emission reduction targets

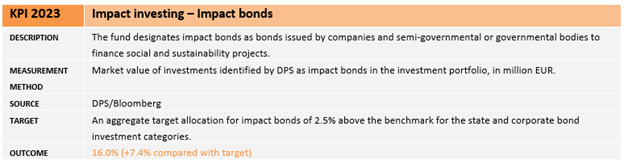

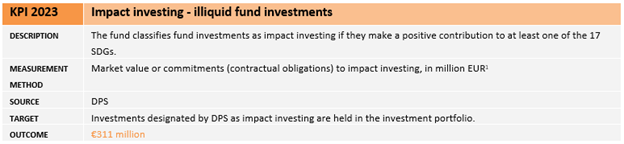

Impact investing is investing in countries, companies or projects that can help resolve social and environmental problems, such as poverty in developing countries and climate change. Pensioenfonds PDN does this on the basis of the United Nations Sustainable Development Goals.

Outcome of Impact Investing targets

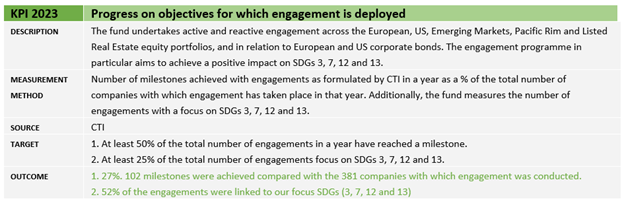

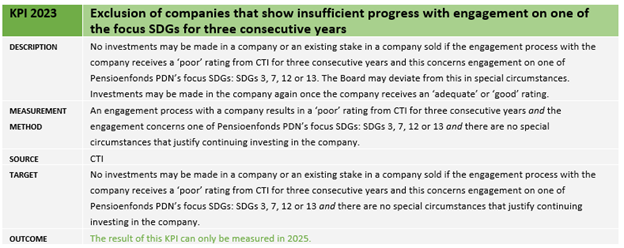

Engagement involves dialogue with the companies in which we invest and helps stakeholders stimulate companies to change. The tool of engagement enables agreements to be made with companies about plans, objectives or ambitions. With respect to carbon emission reduction, for example. Engagement is also used to start a series of intensive dialogues with companies whose conduct is not in line with the UN Global Compact’s principles and where potential or actual negative impact has been identified. An engagement process can be labelled as a proactive or reactive engagement process. If the engagement process does not lead to the desired result, the conditions under which disinvestment takes place are stated in the escalation ladder.

Engagement process

An engagement process comprises four phases. It starts with determining a company-specific objective. CTI then contacts the company concerned to raise the identified issues. CTI then monitors the extent to which the company commits to addressing the issue up to the point that the issues are resolved and the objectives are achieved. Unfortunately, the latter is not always the end of an engagement process. Sometimes, companies do not ‘engage’ during these phases, resulting in the engagement process being aborted.

Outcome of Engagement targets

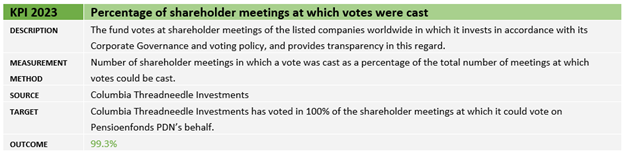

As an institutional investor, Pensioenfonds PDN complies with the Dutch Corporate Governance Code. This code defines principles and procedures for proper corporate governance. PDN’s policy for good governance is intended to protect our interests as a shareholder while at the same time living up to our responsibility in that role. Wherever there is an indication that a company is acting irresponsibly, Pensioenfonds PDN has several options to exert influence, including voting at shareholder meetings of all listed companies in which the fund invests worldwide.

Every quarter, we publish on our website the votes made on behalf of PDN in general meetings of the companies in which we invest. These are published per individual company and per voting point.

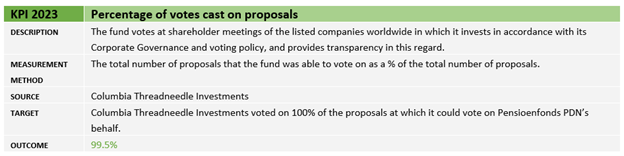

Outcome of Voting Policy and Corporate Governance targets

1,097 shareholder meetings took place in 2023 for all listed companies in PDN’s portfolio. CTI cast votes on behalf of PDN at 1,089 of these meetings. This was not possible at eight meetings due to applicable liquidity constraints or other operational restrictions in the voting process. This means that the KPI was not strictly achieved. However, PDN is satisfied with the result that, where possible, votes were cast at every shareholder meeting.

Votes were cast on over 14,000 proposals at all 1,089 shareholder meetings. As mentioned above, it was not possible to vote at various shareholder meetings, resulting in a total of 0.5% of the number of proposals not being voted on. Votes were cast on the remaining 99.5%. Again, this KPI was not strictly achieved but PDN is satisfied with its voting activity in 2023.

Pensioenfonds PDN’s investment policy produces an investment portfolio that reflects its standards and values. For that reason, the fund excludes companies and countries based on the risk of negative impact and conflict with our norms and values. Pensioenfonds PDN applies criteria for this such as the harmfulness of the product, the impossibility of effecting change through voting and engagement and the fact that there would be adverse consequences if the product ceased to exist.

Product groups that we exclude or partially exclude include controversial weapons, cluster munitions, coal, oil from tar sands and tobacco. We exclude companies or countries based on their behaviour with respect to the UN Global Compact’s Ten Principles and the UN Security Council, Dutch or European Union international sanctions lists. Countries and companies are added to our exclusion list if there are serious and structural violations.

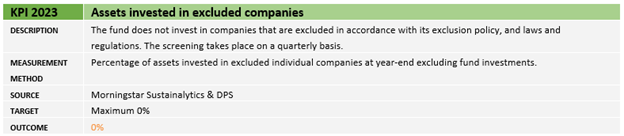

Outcome of Exclusion targets

Our objective for exclusions means that we do not hold any investments, excluding our fund investments, in companies and countries that are on our exclusion list. We have achieved this target. Individual investments in companies and countries on the exclusions list were sold within a calendar quarter of the screening taking place. At the end of 2023, Pensioenfonds PDN’s list of exclusions comprised a total of 174 companies and fourteen countries in the investment universe. This represents an increase of six companies and roughly the same number of countries compared with the end of 2022.

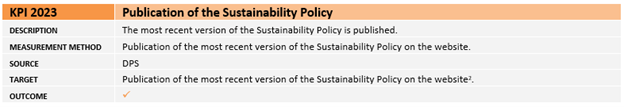

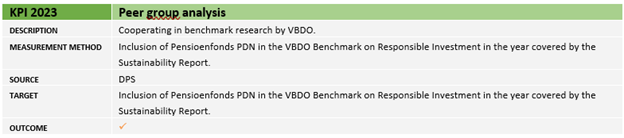

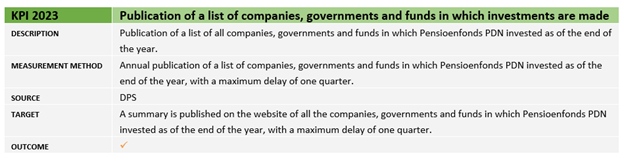

The fund publishes an annual Sustainability Report to ensure transparency about the Sustainability Policy and its implementation. On its website, Pensioenfonds PDN also publishes an annual overview of the outcomes of the total investment portfolio as well as reporting on the results of its voting policy at shareholder meetings. Finally, the fund participates in market-wide initiatives such as the VBDO benchmark and the UN PRI assessment.

Outcome of Transparency targets

Reporting

Pensioenfonds PDN publishes an annual Sustainability Report to ensure transparency about the sustainability policy and its implementation. In this report, we indicate how we handled sustainability in that year and which results were achieved with respect to sustainability.

In the context of transparency about where the fund invests, we publish an annual overview of the total investment portfolio on our website. For more information about this, please read the Investment policy at Pensioenfonds PDN on our website. The website also reports the results of the Vote Summary Report at shareholders’ meetings. PDN Magazine and the website also regularly feature items on the sustainability policy.

Future perspectives

In the coming year, we will continue our efforts to further develop and implement our Sustainability Policy.

When we look ahead, it is clear that various important themes require our attention:

- Digital transformation and sustainability: Technology’s role in promoting sustainability is undeniable. Innovations can contribute to energy efficiency and the development of smart, sustainable cities.

- Water management: Sustainable management of our water sources is essential if we are to ensure that future generations have access to sufficient clean water.

- Social inclusion and employment: Investing in sustainable projects enables us to help create jobs and promote social inclusion, especially in developing countries.

- Circular economy: Supporting companies that embrace circular economy principles is a step towards minimising waste and the efficient use of resources.

- Ethical investment and human rights: It is our responsibility to ensure that our investments embrace ethical considerations and respect for human rights.

- Biodiversity: The protection and promotion of biodiversity is essential if we are to retain the healthy ecosystems that are crucial for life on earth. The investment world is increasing its focus on investments that help protect natural habitats and species diversity.

Although we are aware of the complexity of the challenges we are facing, we also see the possibilities of making positive impact. With dedication, innovation and cooperation, we can help create a more sustainable and just world for everyone.