Pensioenfonds PDN

Pensioenfonds PDN

Pensioenfonds PDN manages the pensions of all companies affiliated to DSM Nederland B.V.

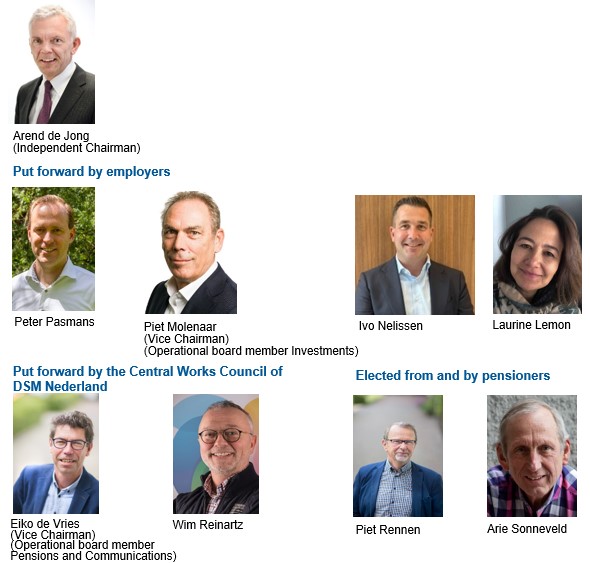

The Board

Pensioenfonds PDN is an independent organization managed by a board, which independently determines how the pension fund operates.

Pensioenfonds PDN's Board is made up of the following members:

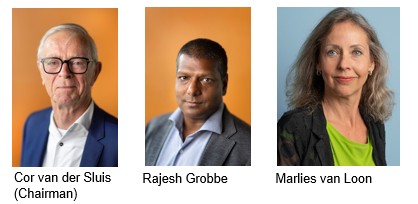

The Supervisory Board

The Supervisory Board supervises the Board, assessing for example whether the procedures and processes of the fund are in order, how the fund is managed and how the Board deals with the longer-term risks of the fund. The Supervisory Board is made up of three members.

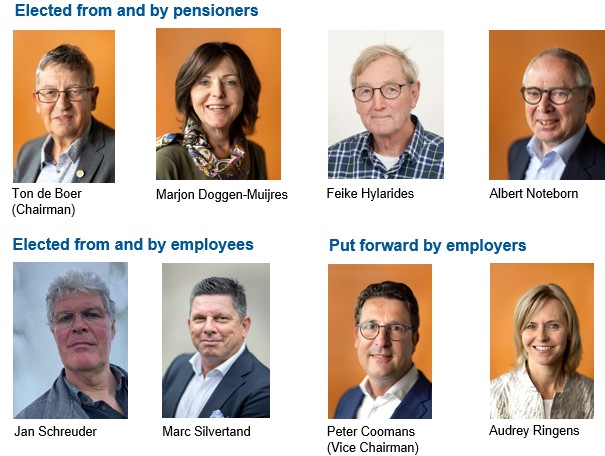

The Accountability Council (AC)

The Accountability Council (AC) is tasked with evaluating the actions of the Board and providing advice on a number of key areas. The Council is made up of eight members.

Pensioenfonds PDN's Accountability Council is made up of the following members:

Click here for more information on the Accountability Council.

In the brochure ‘Pensioenfonds PDN’ on this page you will find more information about Pensioenfonds PDN’s mission, the board, the Supervisory Board and the Accountability Council.

Committees

The Board has set up the following committees:

|

Committees |

Core duties |

|

Investment Committee |

|

|

Pensions and Communications Committee |

|

The DPS pensions administration organization and/or other parties advise the committees. The board has drawn up a description for each committee, which also provides further information: the scope, composition, working method, duties, and powers of the committee concerned.

The Board may set up ad hoc advisory and other committees, the duties and powers of which the Board outlines when appointing the committee.

The IORP II Directive

The Institutions for Occupational Retirement Provision (IORP) Directive has been in force since 2003. It applies to pension funds in the European Union. The IORP II Directive came into effect at the beginning of 2019. IORP II has four main objectives. First and foremost, the Directive aims to improve the functioning of the internal market and make cross-border pension activities possible. In addition, it adds to the supervisory positions within the Board. Furthermore, from 2019 onwards, communication must be the same across all EU Member States that have members and pensioners. Finally, IORP II is designed to provide organizational guarantees for independent and comprehensive risk management.

IORP II requires pension funds to set up key functions to support the Board. This involves risk management, as well as actuarial and internal audit functions. Under IORP II, funds are also required to conduct an own risk assessment at least once every three years. IORP II also sets new requirements for the ways in which pension funds approach sustainable investment.

Key functions

A key function is held by a holder and at least one implementer. The holder is the person ultimately responsible for his or her key function. The implementers implement the key function.

The Board ensures that key functions are performed in an objective, fair, and independent manner. The Board periodically reviews the substance of the function.

The Board has introduced the following key functions:

|

Key functions |

Description |

|

Risk management function |

The Board has decided to outsource the role of key function holder (SFH) for Risk Management. Effective September 1, 2025, Ms. Amba Zeggen succeeded Laurine Lemon as key function holder for Risk Management at Pensioenfonds PDN. |

|

Internal auditor |

The Board has decided to delegate this position to one of the Board members. |

|

Actuarial function |

The Board has decided to appoint the external certifying actuary, through outsourcing, to fulfill the roles of holder and implementer. The first point of contact for the actuarial key function holder is one of the Board members who is a member of the Pensions and Communications Committee. The Actuarial key function holder reports to the Board. |

DPS

The board has delegated the actual activities of the pension fund to DPS, although it remains accountable for everything that DPS does. Click here for more information on DPS.