Terms

What is the flat-rate contribution system?

In the former and new pension, your employer and you both pay pension contributions that are determined in the same way for everyone.

However, in the former pension, this contribution for young people is actually too high for the pension they will receive. This is because we can invest a younger person’s contribution for a long time, which means that the contributions will yield more returns than an older person’s contributions. For this same reason, the contributions that an older person pays for their pension are actually too low. We can only invest these contributions for a short period of time and this, therefore, yields low returns.

That is why we use part of young people’s contributions in the current pension to finance the pensions of older people. This is known as the ‘flat-rate contribution system’.

This works well as long as the young people themselves can also benefit from this system later on.

Abolition of the flat-rate contribution system and contribution compensation

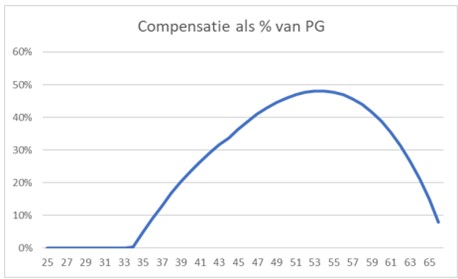

This system will end in the new pension. Young people will benefit immediately from this as they will immediately receive more pension for the same contributions. However, older people who are still accruing pension are at a disadvantage. In the past, they will have transferred part of their contribution to older people, but the young people of today will not be doing that for them. This disadvantage is age dependent. It starts with members from 34 years, although their disadvantage is limited. The biggest disadvantage is experienced by 45 to 60-year-olds who are still accruing pension.

For this reason, everyone who is still building up a pension and is disadvantaged by the abolition of the flat-rate contribution system will receive a compensation. The amount of compensation is equal to the percentage that corresponds to the age, multiplied by the pensionable salary. We call that the premium compensation.

This diagram shows which supplement to the personal pension pot is needed per age category to compensate the disadvantage as a consequence of the abolition of the flat-rate contribution system. The level of this supplement is expressed as a percentage of your own pension base.

The contribution compensation will be paid as soon as we switch to the new pension. On the transition to the new pension, everyone who is eligible will receive an additional amount added to their personal pension pot.

A certified copy is a copy of an official document signed by a lawyer, civil-law notary, or a foreign authority and bearing an official stamp.

Your former partner's own right to a retirement pension. The pension of your former partner is separate from your own retirement pension and partner's pension.

You confirm to PDN in a 'doorwerkverklaring' (declaration of employment continuation) that you are still in employment on the PPS date and intend to continue working after that date.

A declaration in which you indicate that you will terminate your paid work when the PPS benefit commences.

If you only convert part of your PPS balance into a PPS benefit, you must declare that you reduce your paid work for that part.

This Act sets out how the retirement pension should be divided in the case of a divorce. This Act provides for a standard division. Under this standard division, the former partner has a claim to half (50%) of the retirement pension accrued during the time of the marriage or partnership.

Exchanging one type of pension for another. For example, exchanging a partner's pension for an extra old-age pension.

The portion of the gross salary that counts towards pension accrual. For the collective pension scheme, the fixed pensionable salary (fixed income) is capped at €137,800 (2026 threshold).

The fixed pensionable salary that you receive when you work full-time (100%) is used to determine whether you are eligible for the NPS. If you work part-time, this will be taken into account when determining whether your pensionable salary falls above or below the threshold amount.

Is the salary you receive for full-time (100%) employment. The full-time salary is used to determine your eligibility for the NPS. If you work part-time, this will be taken into account when determining whether your salary falls above or below the threshold amount.

Click here for an example of how the threshold amount is calculated for a part-time employee

The portion of the gross salary that counts towards pension accrual. The gross pensionable salary according to the collective pension scheme is subject to a maximum of €137,800 (2026 limit).

In order to receive a PPS benefit it is necessary that you:

- Have a PPS balance at Pensioenfonds PDN;

- Have not yet made a choice with regard to converting your PPS balance into a benefit;

- Will reach the PPS age within three months.

This is the Early Retirement/Pre-Pension (Adjustment of Tax Treatment) and Life-Course Savings Scheme Act (Wet aanpassing fiscale behandeling VUT- en prepensioenregelingen en introductie levensloopregeling). It is legislation dating from 2006 in which the government encourages as many people as possible to continue working until they reach 65 years of age.

The pension contributions will be invested in a mix of riskier and less risky investments, depending on your age. We will automatically adjust this mix as you get older. As a result, the investment risk gradually decreases as your retirement date approaches.

The pension contributions will be invested in a mix of riskier and less risky investments, depending on your age. We will automatically adjust this mix as you get older. As a result, the investment risk gradually decreases as your retirement date approaches.

Is the pension capital that is built up in the Net Pension Scheme (NPS).

A pension scheme for net pension accrual over a gross annual salary above €137,800 (2026 limit). You pay tax on your and your employer's contribution. The pension is no longer taxed from the retirement date and is paid net.

This is pension capital accrued in the Net Pension Scheme (Nettopensioenregeling, NPR). NPR is the scheme through which a pension can also be accrued over the salary above the gross annual salary level of €137,800 2026.

Benefit for the children of an employee who has not reached a certain age upon their death. The age limit is set at 18 years and for children studying at 27 years.

Partner's pension is the pension to which the partner is entitled upon your death. This means that your partner will receive a benefit payment from Pensioenfonds PDN after your death. Your partner will receive the partner's pension until his or her death. The amount of the partner's pension depends on when you die and whether you are still accruing pension with Pensioenfonds PDN. Upon your death, Pensioenfonds PDN will take care of the payment of the partner's pension to your partner.

Pensioenfonds PDN sees the following as a partner:

- the spouse

- the person with whom you have a registered partnership

- the person with whom you have entered into a notarial cohabitation agreement and who you have registered as your partner with Pensioenfonds PDN.

This is the State Retirement Age minus three years.

Until 2006, employees of a number of DSM companies could save by means of a pre-pension scheme or accrue entitlements via an early retirement scheme to retire early.

There is no longer a guarantee that people will be able to retire early, i.e. stop working at a certain age with a certain percentage of their salary.

DSM commuted this guarantee at the end of 2005 by adding extra money to the PPS balance of the then members on a one-off basis.The PPS balance is stated on the annual Uniform Pension Statement (UPS).

A temporary pre-pension benefit. The amount of this temporary benefit depends, among other things, on the PPS balance used for this benefit.

The date on which your PPS balance is converted into old-age pension and temporary or permanent partner's pension. After conversion, you no longer have a PPS balance.

Periodic payment with effect from the retirement date, awarded to the member or deferred member. The retirement pension is paid out until the death of the pensioner.

The partner's pension to which your former partner is entitled (whether permanently or temporarily) after the end of a relationship. Just like the 'standard' partner's pension, the special partner's pension is paid out after your death.

A stable pension benefit does not change unless the pension fund increases the payment or – in exceptional situations – has to reduce this.

This division is governed by the Equalization of Pension Rights in the Event of a Divorce Act (Wet Verevening Pensioenrechten bij Scheiding, WVPS) and means that the former partner is entitled to half of the retirement pension accrued during the marriage or registered partnership. The same applies to the PPS balance and the Net Savings Capital.

The state retirement age is the day on which you receive your state pension from the government.

Your state retirement age depends on your date of birth and will increase in steps in the years to come.

First look at the period in which you were born in column 1. Then see column 2 for your state retirement age on the basis of the Pension Agreement 2019 (“Pensioenakkoord 2019”). You can also see in which year that is. You will recieve your state pension from the day you reach your state retirement age.

| Born in period: | Your state retirement age is then: | |

| 01-01-1953 to 08-31-1953 | 66 years and 4 months | this is in 2019 |

| 09-01-1953 to 08-31-1954 | 66 years and 4 months | this is in 2020 |

| 09-01-1954 to 08-31-1955 | 66 years and 4 months | this is in 2021 |

| 09-01-1955 to 05-31-1956 | 66 years and 7 months | this is in 2022 |

| 06-01-1954 to 02-28-1957 | 66 years and 10 months | this is in 2023 |

|

03-01-1957 to 12-31-1957 01-01-1958 to 12-31-1958 |

67 years 67 years |

this is in 2024 this is in 2025 |

If you were born after December 31, 1957

Your exact state retirement age is not yet known because it depends on life expectancy..

Your state retirement age will however be at least 67 years. Your final state retirement age is determined five years before your state retirement age starts. More information about the state retirement age is given at: www.svb.nl.

A statement in which you indicate that you will end your paid employment when the PPS benefit starts.

If you only convert part of your PPS balance into a PPS benefit, you must declare that you are reducing your paid employment for that part.

A standard statement that pension funds and insurers send to members annually to inform them about the benefits in the event of retirement, death and disability.

UWV stands for: Employee Insurance Agency.

If you become unemployed or disabled, you will be confronted with the UWV. If you are entitled to benefits such as unemployment benefits, WIA or disability benefits, you will receive this from the UWV. The UWV does this on behalf of the government.

For more information, visit www.uwv.nl.

A value transfer implies that you move your accrued pension entitlements to your new pension provider, for example in case you switch jobs and thus change your pension provider. There are certain condition attached to value transfers

The variable income is the part of your income that is not fixed income. It usually depends on targets or performances.

Examples include a profit distribution, production or performance bonus, commission, or share of turnover (DVO).

If you want to know exactly what falls under variable income within your company, please consult the document “Overview variable components per employer”.

This is the variable income, the part of your income that is not fixed income. It usually depends on targets or performance. Examples include a profit distribution, production or performance bonus, commission, or share of turnover (DVO).

The document ‘Overview of variable components per employer’ summarizes per employer exactly what constitutes variable income.

The WIA (Work and Income Act) is based on a person’s capacity to work. The WIA also provides income protection in the event of occupational disability. The act consists of two parts:-the Return to Work for the Partially Disabled Scheme (WGA) and-the Persons Wholly Unit for Work Income Scheme (IVA).